Florida’s population has reached a record 23.3 million people, marking one of the fastest growth…

South Florida Commercial Real Estate Performance Summary

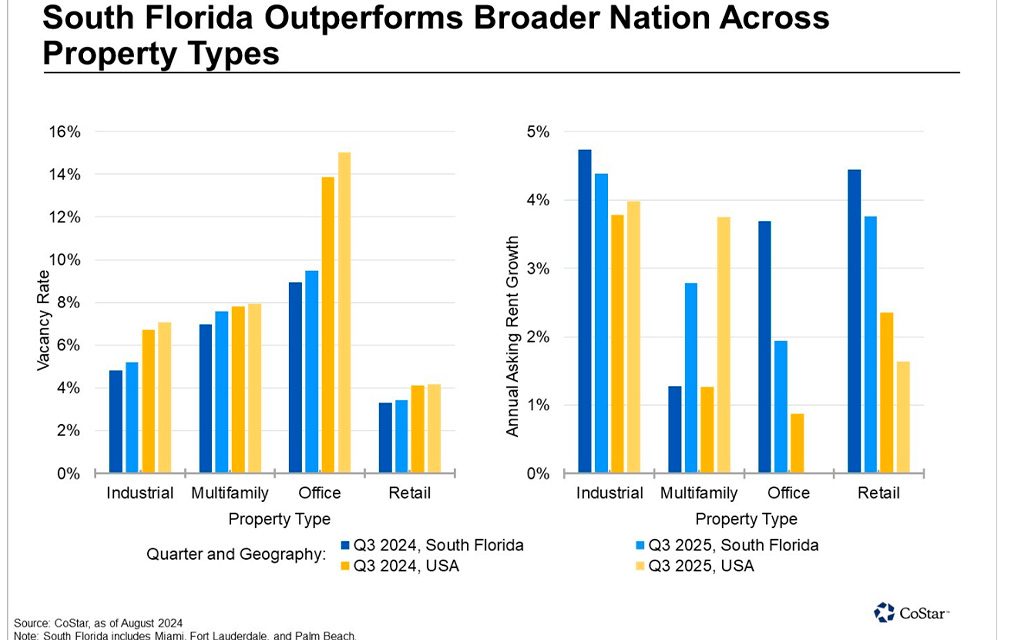

Over the last year, the South Florida commercial real estate market has remained resilient despite the wider economic slowdown. Still, moderate demand across property types has slowed rent gains, while new construction has widened space availabilities, particularly in the multifamily and big-box industrial segments.

The most significant change from our prior update has been the marked slowdown in asking rent growth for the industrial segment. In 2023, industrial rents increased nearly 10%, but annual rent growth has now slowed to around 5% across the region.

A slowdown in leasing activity, specifically from large third-party logistics (3PL) players, has impacted net absorption, with markets like Fort Lauderdale seeing net move-outs totaling over 700,000 square feet over the last year. Absorption is the change in the number of occupied square feet.

Although large properties have around two to three years of supply availability, market participants have indicated that the institutional background of most of South Florida’s large-block developers means they can afford to wait for the right tenant. Rather than dropping rent, landlords are offering a couple of months of free rent and tenant improvement allowances.

In contrast to larger spaces, properties demised into smaller tenant spaces have seen faster lease-ups, taking less than 10 months to lease on average, relative to single-tenant properties, which take a year or more. Additionally, multi-tenant properties with less than 100,000 square feet continue to see tighter availability rates as most tenants, around 90%, typically look for blocks of space of less than 50,000 square feet.

Multifamily properties are also seeing a rise in vacancies due to new supply, particularly in Palm Beach and Fort Lauderdale, which have vacancy rates of 9.4% and 7.3%, respectively. Miami, which faces the bulk of new supply in South Florida, has retained vacancies of less than 7% as demand has been relatively healthier here.

Still, while new completions are expected to moderate going forward, they will remain elevated across the region relative to historical levels. This will keep demand in “catch-up” mode over the next year or so, resulting in higher vacancies, slower lease-ups, and moderate rent gains, particularly for luxury properties.

New properties are competing by offering significant concessions of over 2 months of free rent and have been holding asking rents flat for over a year now. Around a quarter of multifamily properties in the market now offer some sort of concession, up from less than 5% a few years ago.

Retail vacancy remains the lowest among commercial property types in South Florida at around 3%. A limited amount of new construction for this market segment is expected to result in minimal vacancy expansion and healthy annual rent gains of over 3% through the end of the year.

However, top tourist submarkets along Miami’s coast, which have seen a more significant increase in new supply and a slowdown in international tourist visits, have underperformed since 2019. While international tourism returns to growth mode, the evolution of these areas will remain in focus as new mixed-use retail developments here impact older and existing space across the wider market.

Office properties continue to see some of the highest vacancy rates at over 8% in South Florida, though this remains well below the U.S. average of over 13%. Miami and Palm Beach continue to perform relatively well, with office vacancy rates below 9%, while Fort Lauderdale’s stands at around 10%.

Miami continues to see the highest new office construction activity in the nation. Still, the market has absorbed most of its new deliveries over the last few years. Despite this, the area is not immune to broader office market headwinds, with occupier demand remaining in flux. Some occupiers like Kirkland Ellis and Ryder have reduced their office footprints as space needs continue to evolve.

Company relocation and expansion announcements have continued this year as well, though at a slower pace. JPMorgan announced it is doubling its footprint in the Brickell area as the bank adds new jobs. Additionally, Apple and Amazon indicated office expansion plans, with Apple leasing 45,000 square feet in the increasingly popular Coral Gables Submarket.

Going forward, as tenants continue to downsize and move into newer and higher-quality urban space, older office inventory remains at risk, as there is simply not enough demand to back-fill vacated space.

Source: https://product.costar.com/home/news/shared/673619989

This Post Has 0 Comments