Florida’s population has reached a record 23.3 million people, marking one of the fastest growth…

Small Bay Industrial Properties See Healthy Leasing and Limited Supply in South Florida.

While the large warehouse segment of the industrial market continues to grapple with the effects of a rise in supply and moderating demand, small bay industrial space remains in short supply, specifically in South Florida.

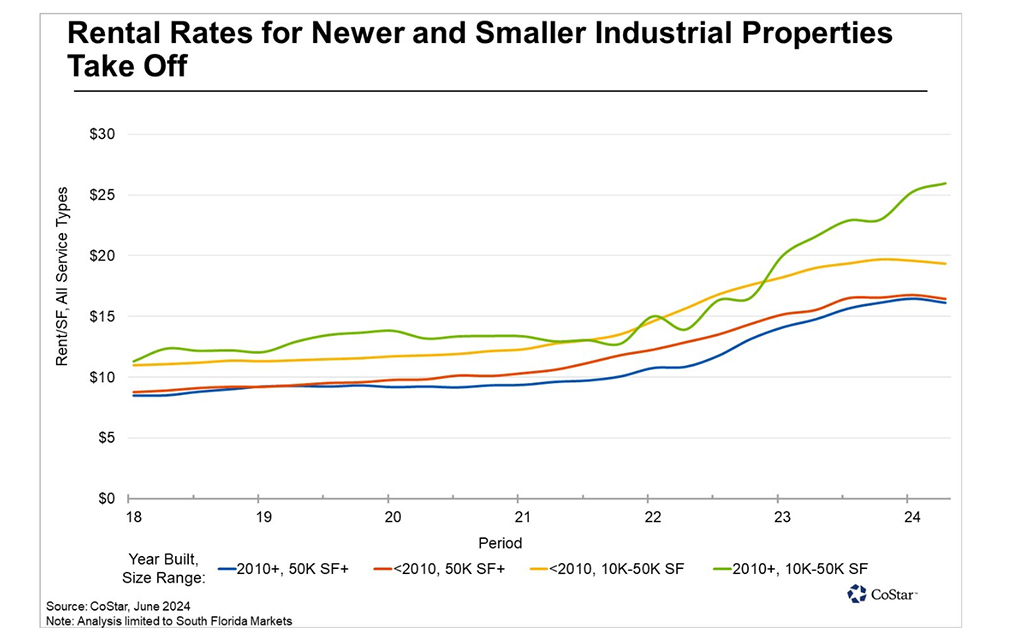

Larger industrial properties, with more than 50,000 square feet, have seen their vacancy rates climb from lows of 3% in 2023 to over 6% as of July 2024. This vacancy expansion has been driven by an increase in supply along with a drop in leasing activity to pre-pandemic average levels from 2015 through 2019. While this near-term supply/demand imbalance for larger properties has hindered rent gains for the sector over the last few quarters, as shown in the blue and red lines above, the small bay sector of the market has continued to see rising rents.

Rent growth in newer and smaller properties has outpaced the region’s average since 2023, as indicated by the green line above. Average rents for this market segment have risen to around $25 per square foot in South Florida, a 20% increase from average rent levels of around $21 per square foot seen a year ago. These rent gains, which have outperformed all other size and age segments since 2023, have been driven by a mix of limited construction and strong leasing activity for this market segment in the last year.

In fact, leasing activity for smaller spaces has remained the healthiest across the board for both newer and older spaces. Available space in properties between 10,000 and 50,000 square feet in size averages less than three months on the market before leasing. Spaces in larger properties, and specifically those newer builds, last around nine months on the market before leasing.

Over the last year, the number of lease deals signed in smaller and newer spaces has increased significantly, rising to the highest level seen since 2019, as shown by the green line above. Older and smaller spaces, tracked by the yellow line above, have seen leasing activity fall to around 80% of the max level seen since 2019. While larger spaces, whether older or newer, are seeing leasing activity at around 60% to 70% of peak levels over the same period.

Over 60% of leasing activity for properties larger than 10,000 square feet in South Florida is concentrated in properties between 10,000 and 50,000 square feet. This provides the small bay segment of the market with a significant demand pool from which to draw potential tenants. The high concentration of leasing activity, coupled with a bleaker supply picture when compared to larger properties, presents an opportunity for continued rent gains going forward.

The square footage of small bay inventory in South Florida, including both newer and older properties, has increased by less than 1% since 2019, while larger properties have seen a rise of over 35% in the same period.

Going forward, the inventory of newer and larger industrial space, those properties built since 2010, is expected to continue to rise significantly, increasing around 14% in 2024. On the flip side, newer small bay space is expected to grow at less than 5% annually over the coming year.

Additionally, once we look at the broader small bay space, including both older and newer properties, inventory here is expected to contract through 2026, driven by continued demolitions of older properties. This shrinking of existing inventory, coupled with a large and healthy tenant demand pool, presents a strong case for continued rent growth outperformance for newer small bay industrial space relative to its larger counterpart.

Source: https://product.costar.com/home/news/shared/1531437217

This Post Has 0 Comments